Share Insurance

CEFCU is a Federally Insured Credit Union

The shares in your credit union are insured by the National Credit Union Share Insurance Fund (NCUSIF), which is backed by the full faith and credit of the U.S. Government. Established to insure member share accounts at federally insured credit unions, the NCUSIF is managed by the National Credit Union Administration (NCUA).

Important to know about your share insurance coverage:

- Your share insurance coverage is similar to the deposit insurance coverage offered by the Federal Deposit Insurance Corporation (FDIC).

- The Standard Maximum Share Insurance Amount for a credit union member is $250,000.

- You can increase your coverage by setting up different types of accounts because the $250,000 coverage is per qualifying account.

- No member of a federally insured credit union has ever lost one penny of insured savings.

Reminder: Review your accounts periodically and whenever you open a new account or modify existing accounts to ensure that all your funds remain insured.

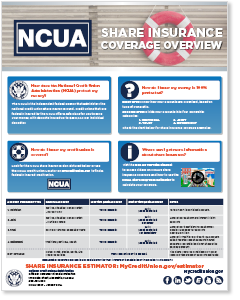

Share Insurance Coverage Overview

- How does the National Credit Union Administration (NCUA) protect my money?

- How do I know my money is 100% protected?

- How do I know my credit union is covered?

- Where can I get more information about share insurance?

How does the National Credit Union Administration (NCUA) protect my money?

The NCUA is the independent federal agency that administers the National Credit Union Share Insurance Fund. Credit unions that are federally insured by the NCUA offer a safe place for you to save your money, with deposits insured up to $250,000 per individual depositor.

How do I know my money is 100% protected?

- FIRST STEP: Know how your accounts are organized, based on type of ownership.

- SECOND STEP: Divide your accounts into four ownership categories:

- 1. Individual

- 2. Joint

- 3. Trust

- 4. Retirement

Check the chart below for share insurance coverage examples.

Share Insurance Coverage Examples |

||||

|---|---|---|---|---|

| Account Ownership Type | Example Account | Less Than $250k Account | Greater Than $250k Account | Notes |

| 1. Individual | Savings, Checking, Money Market – For Self Only | You’re covered! | Up to $250k protected |

Total amount in combined accounts. |

| 2. Joint | Savings, Checking, Money Market – Multiple Owners | You’re covered! | Up to $250k protected per owner |

Amount per each owner’s interest in joint accounts. |

| 3. Trust | Formal or Informal Revocable Trusts | You’re covered! | Up to $250k protected per beneficiary |

Amount per beneficiary, for each owner. Special rules apply for accounts over $1.25 million |

| 4. Retirement | Traditional/Roth IRA, Keogh | You’re covered! | Up to $250k protected |

Amount in traditional and Roth IRA accounts added together. Keogh accounts insured separately. Beneficiaries do not change the coverage amount. |

| NOT COVERED | Mutual Funds, Stocks, Bonds, Life Insurance Policies | Your losses will NOT be covered. | The Share Insurance Fund does NOT cover losses on these types of accounts and funds. | |

|

Please note: Separate coverage is also available for the trust interests of beneficiaries of irrevocable trust accounts |

||||

How do I know my credit union is covered?

Look for the NCUA share insurance sign or use the NCUA Credit Union Locator to find a federally insured credit union.

Where can I get more information about share insurance?

Visit NCUA’s Consumer site, MyCreditUnion.gov

Additional Resources

How Your Accounts are Federally Insured

Highlights on the basic share insurance coverage provided by NCUA for various account types. Read the pamphlet.

Your Insured Funds

An in-depth look at NCUA’s Share Insurance coverage. Includes examples to help you understand the protection provided. Read the booklet.

Share Insurance Coverage Overview

An overview of share insurance coverage provided by NCUA. View the flyer.

Share Insurance Estimator

MyCreditUnion.gov

Source: National Credit Union Administration, Office of Consumer Financial Protection, NCUA 12007 – January 2018.